I had a nice long conversation with a client the other day regarding the potential that either the Canada Revenue Agency (CRA) or the Provincial government (in Ontario) were going to pursue a Director’s Liability assessment against him for the debts of his now-deceased corporation. Part of the discussion surrounded how the Canada Revenue Agency and the former Ontario Retail Sales Tax (RST) group handled assessments, and the criteria they used when reviewing whether or not to pierce the corporate shield, plus the importance of a due diligence defense.

During my employment at the Canada Revenue Agency (CRA), I felt I needed to gain a more thorough understanding of Director’s Liability and figure out why there were so few assessments raised in our office compared to other offices. I personally had not raised any Director’s Liability assessments mainly because I was effective on the phone and combined with meetings, was able to resolve many debts prior to the assessment stage. Still, Senior Management encourage the Collections staff to utilize this collection tool more, so as the Resource and Complex Case Officer, I asked for, and was given, the Director’s Liability inventory to control.

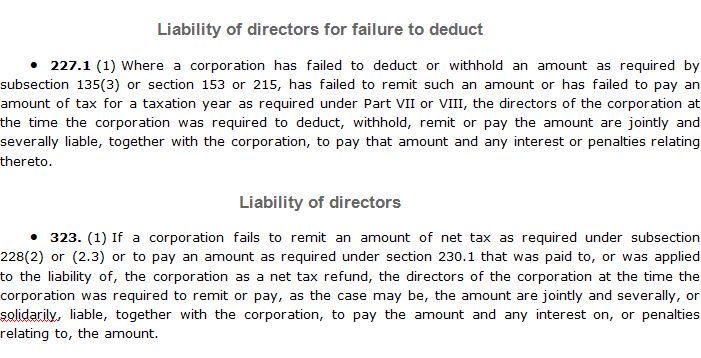

By controlling the Director’s Liability inventory, that meant I needed to know the ins and outs of Director’s Liability – section 227.1 of the Income Tax Act and section 323 of the Excise Tax Act, because if anyone in our office wanted to raise an assessment, I would have to review their account, ensure all of the much-needed grunt work had been completed, then ensure they had spoken to the Director(s), given them sufficient notice, provided them time for a Due Diligence Defense, at which point I could sign off and begin to track the file.

After organizing that inventory and rolling out the new procedures, I began to scour the accounts in our office for potential Director’s Liability assessments, then, in addition to my other inventories, provide recommendations and suggestions to the staff on how to proceed if I felt there was a possibility for an assessment. Management decided instead of burdening the staff, I should just take those accounts I felt were ready for Director’s Liability assessments and work them, plus all of the other accounts I was tracking where assessments were raised too.

It was a fair amount of work, but more importantly, it was very enlightening, to review the government’s policies on Director’s Liabilities plus review the procedures in place, compare that to how other office’s handled their files and really tighten up the process. If an account was a sure-fire Director’s Liability assessment, it was raised, and if there was no chance, or not the right time, the file was returned to active collections.

I found the first common misconception around Director’s Liability was that the issuance of the Director’s Liability Pre-Assessment Proposal Letter (which notifies director’s that we are reviewing them for Director’s Liability) was being used as just another letter by the Collections staff to remind directors of their obligations, when in fact the CRA intended on using this letter to notify Directors’ that an assessment was beginning. Internally, the Canada Revenue Agency was actually starting to investigate the personal ability to pay of the director(s) at the time this letter was issued.

Going forward, that letter was not to be used lightly, and it was not to be sent to the Director(s) numerous times. A Director would then have the assessment raised against them and wonder why it was raised this time, and not earlier when one of those letters went out, so in order to prevent a possible loss in Tax Court, the decision was made to send it once, and then follow-up with the Due Diligence defense letter before raising the assessment.

Ignoring the Due Diligence defense letter (which happens often) meant the one opportunity a Director had to start their case on the record was lost, and with the CRA building their case in the permanent diary, the Director(s) stood little chance of preventing the Canada Revenue Agency from raising the Director’s Liability.

Once that waiting period passes, the file usually gets very quiet…

From the Director’s point of view, either the assessment is raised and they receive a letter from the CRA stating that, or the assessment is raised and the letter gets lost in the mail (tossed out), or the assessment is raised and before the Director is notified, their personal assets come under fire. There is of course, the possibility that nothing happens and the Director(s) are left in limbo, but without having a dialogue with the CRA, or experience around the policies and procedures, there is no way that the Director(s) will know when and if the CRA is coming – if at all.

Once raised, the Director(s) have quite limited options.

A recent court case, which I will highlight below demonstrates a situation where an assessment was raised, and in Tax Court, the decision was turned over and the assessment cancelled. I guarantee it won’t happen again, as the CRA will ensure their processes are tightened even more to close this loophole.

The case was Bekesinski V The Queen.

The link to the case on the website for the Tax Court of Canada, is here.

In this case, Bekesinski was the Director of a corporation who was personally assessed by the Minister of National Revenue (CRA) in the amount $477,546.08 for the corporation’s unremitted income tax (T2) and employer contributions of CPP and EI for payroll (source deductions) plus penalties and interest for the 2001, 2002 and 2003 fiscal years.

Under Director’s Liability, the CRA can assess directors for payroll and for GST/HST, but not Corporate Tax liabilities.

The Tax Court of Canada held that since the taxpayer had resigned as a director of the corporation more than two years after the CRA’s assessment, the CRA was statue barred from raising the Director’s Liability assessment.

This was something the CRA should have known before raising the assessment and something that the director (or his representatives) should have mentioned at any point during the pre-assessment proposal period, especially at the due diligence defense stage, but was never mentioned.

Brief Overview of the Facts

In 1992 the taxpayer purchased D.W. Stewart Cartage Ltd., a general cartage, trucking and warehousing company where he served as a Director of the corporation.

When the corporation fell behind on filing obligations and as the balance owing to the CRA began to grow, the Director began to receive numerous letters from the CRA warning him that he could be held personally liable for the corporation’s tax debts as a Director of the corporation. He did not notify the CRA at any time that he had resigned as a Director of the corporation.

On October 15, 2010 the CRA raised Director’s Liability and issued a Notice of Assessment (NOA) to the taxpayer for unremitted income tax, employer contributions plus penalties and interest in the amount of $477,546.08.

The Director then argued that he should not have been assessed as a Director because he resigned as Director of the corporation on July 20, 2006 by way of a Notice of Resignation which would have made the raising of the assessment statute barred.

The CRA argued that the taxpayer was in fact a director and that the taxpayer had backdated the resignation to qualify for the exception, which happens more than you could imagine, and to counter this trick, the CRA often requests an “ink date test” to determine the authenticity of the Notice of Resignation.

Unfortunately for the CRA, the results from the ink date test was excluded by the Tax Court because the CRA did not advise the Court that they felt the Notice of Resignation was back-dated. Even the judge felt the Notice of Resignation was backdated, however since the CRA failed to mention it, it was not open for review in the Court.

In summation, Bekesinski avoided Director’s Liability for the corporate tax debts due to a litigation misstep on the part of the CRA, a mistake they are unlikely to be repeat.

It is highly advisable for corporate directors to carefully document their resignations so as to avoid potential future Director’s Liability assessments, because I guarantee, the CRA will challenges to the authenticity of backdated resignations on each and every case going forward.

Thanks so much for this blog. It is very informative

LikeLike