George Nkoke Nnane of Richmond Hill, Ontario, was sentenced in the Superior Court of Justice in Toronto to 4-years in jail for filing fraudulent tax returns, the CRA has reported.

Tag: penalties

CRA Targeting Underground Economy Again (or Still)…

Recently saw a news headline relating to the Canada Revenue Agency (CRA) and collecting taxes, that caught my eye. The headline screamed something to the effect of; “Contractors buying from Home Depot beware — the CRA is coming after you.”

I immediately began to shake my head and wonder if what the purpose of this article was. Was it written in response to an action taken by the CRA, or was the headline intended to scare Canadians who are dealing in cash and not paying their tax, into using their services.

Afterall, this really is not news.

For as long as Canadians have found ways to evade paying taxes, the CRA has had to find ways to verify that taxpayers are reporting their accurate income – and reporting at all.

The latest instance came to light recently as the CRA sought information from The Home Depot, in July, using a provision in the Income Tax Act (ITA), known as the Unnamed Person Requirement (UPR).

The CRA obtained a Federal Court order (which they are required to do) which legally required the Home Depot to disclose the identities of their commercial customers as well as the total annual amount spent by each of these customers between January 1, 2013 and December 31, 2016, Canada-wide.

Certainly, there are some Canadian Contractors who work solely for cash, and the CRA will use this information with the information that has been filed by these individuals, to determine if an audit is necessary.

The CRA will likely move quickly in cases where there are clear discrepancies, such as contractors who claimed $1 in income, who appeared at the top of the Home Depot list, and who live in, or own, millions of dollars of assets. In these cases, the CRA would send a letter, followed 30-days later by an assessment, and the taxpayer has 90-days to appeal that assessment with facts. Facts, being supporting documentation such as proof, receipts, explanations, and bank statements to prove that nothing untoward had occurred.

I’m not going to lie when I say that in the almost 11-year working in the CRA and the almost 11-years since I left the CRA, I have seen pretty much everything. Some good, some really good, but some bad, and some really bad.

The fact that the CRA found this tax evasion is part of the bigger problem around tax advice being given to people from people who have no idea what they’re saying. As a result, the CRA has to jump in, assume everyone is lying, cheating and stealing, and paint everyone with the same brush.

It gets worse, if these tax evaders filed tax returns and lied about having no income and received benefits based on earning no income, when in fact they earned considerable amounts of income and then took benefits they were not entitled to received from hard-working Canadians who pay their taxes. In those cases, these tax cheats can expect the CRA and the courts to come down much harder on them.

When taxpayers are convicted of tax evasion, they must still repay the full amount of taxes owing, plus interest and any civil penalties assessed by the CRA. In addition, the courts may fine them up to 200% of the taxes evaded and impose a jail term of up to five years.

Didn’t shop at Home Depot? You’re not out of the woods yet. In addition to this list from Home Depot, the CRA also compiled lists of municipal building permits by way of seeking out unregistered building subcontractors. The review of 8,396 building permits yielded 2,751 unregistered building contractors.

According to a CRA report released in late 2018, underground activity in Canada totalled $51.6 billion in 2016, which could have gone into the tax coffers.

When seeking permission from the court to have the Home Depot hand over their records, the CRA stated that 7% of an unidentified company’s customers had were not filed up-to-date on their personal tax returns, meaning a greater chance of tax evasion (which people think, but again, is totally not true).

Many audit and collection projects within the CRA make use of unnamed persons requirements (UPRs), tips from the CRA’s Informant Leads Line (Snitch line) and from Canadians themselves who fail to file tax returns on time.

If you, or someone you know falls into this category, you are best to contact us at inTAXicating, to help answer questions truthfully about how much exposure you might have to the CRA and what solutions are available to help.

We can be reached at: info@intaxicating.ca

Winnipeg insulation company to pay nearly $500K in fines and back taxes for tax evasion

The Canada Revenue Agency (CRA) has announced on their website that a Winnipeg-based insulation company has been fined after underreporting its taxable income by more than $1 million.

The CRA’s Investigators found irregularities in the books and records of Thermo Applicators Inc., such as, that the company’s president included personal expenses in the company’s books, including construction costs for a cabin near Kenora, Ont. and a vacation home in Mexico, as well as a fly-in fishing trip. None of these are eligible tax deductions.

Thermo pleaded guilty in Manitoba provincial court on May 21 to two counts of making false or deceptive statements in the 2009-14 tax years. The court found $1,139,000 million in taxable income went unreported, in addition to the claiming of ineligible expenses.

As a result, the company is being ordered to pay $190,142 in income tax and $47,611 of sales tax that should have been withheld. In addition to paying the taxes, the company was fined $237,753.

Once penalties and interest are added to the debt dating back to 2009 the balance will shoot up well over $500,000.

This conviction is a clear reminder that failing to declare income and claiming false expenses can be very costly should the CRA perform and audit and find it.

Keep good records, report all income and claim eligible expenses.

Canadians Must Hold Governments Accountable For Their Spending of Tax Revenue

The average Canadian family’s largest expense is taxes.

Therefore it should not be unreasonable that Canadians expect all levels of government to not waste their tax dollars, money taken off their paychecks and paid into the system.

Whether tax dollars are wasted when a government pays a negotiation bonus to unions, or if they have to pay private companies a fine after breaking contracts with them, governments must do a better job at keeping the optics above-board and avoid $200,000 moving expenses or $1300 a person dinners altogether!

But they don’t, or they can’t, and we, as Canadians have come to expect that from our elected officials.

If governments want to spend fast and loose with money, let it be their own, or at the very least taxes off of non-Canadians – like withholding taxes, or something of the like.

But if we, as Canadians do not hold these governments accountable for their spending of our taxes, we allow them to continue to do this and they will continue to do so.

If we held our elected officials to a higher standard and used the opportunity to remove governments who wasted taxpayer dollars immediately, it would send a message to the next government that they have to spend wisely.

This information came out in the late summer months from the Fraser Institute, an economic think-tank.

To clarify, when referring to taxes, its not just income taxes, but all the taxes Canadian Taxpayers make to all levels of governments (federal, provincial, and local), including both visible and hidden taxes— everything from income taxes, which are less than a third of the total, to payroll taxes, sales taxes, property taxes, health taxes, fuel taxes, vehicle taxes, import taxes, alcohol taxes, and much more.

In a recent report published by the Fraser Institute, they tracked the total tax bill of the average Canadian family from 1961 to 2014.

For 2014, they estimated that the average Canadian family (including unattached Canadians) earned $79,010 in income and paid $33,272 in total taxes—or 42.1% of income—while just 36.6% went to food, clothing, and shelter combined.

Indeed, Canadian families spend more on taxes than the basic necessities of life.

But it wasn’t always this way.

Back in 1961, the first year the Fraser Institute started tracking this data, the average Canadian family paid a much smaller portion of its household income in taxes (33.5%) while spending proportionately more on the basic necessities (56.5%).

Since 1961, Canadians’ total tax bills have increased by 1,886%, dwarfing increases in shelter costs (1,366%), clothing (819%), and food (561%). Even after accounting for inflation (the change in overall prices), the tax bill shot up 149.2% over the period.

And now taxes eat up more income than any other single family expense.

So why should Canadians care, aside from the fact that we work really hard to earn an income, and pay these taxes?

With more money going to the government, families have less to spend on things of their own choosing, whether it’s a new car, technological gadget, or family vacation. They also have less money available to save for retirement and their children’s education, or to pay down household debt.

While there’s no doubt that taxes help fund important government services, the issue is the amount of taxes that governments use compared to what we get in return.

To make an informed assessment, you must have a complete understanding of all the taxes you pay. Unfortunately, it’s not so straightforward because the different levels of government levy such a wide range of taxes—with many taxes buried in consumer prices and hard to discern.

Armed with this knowledge, we can hold our governments more accountable for the resources they extract and continue a public debate about the overall tax burden, the amount and scope of government spending, and whether we’re getting our money’s worth.

Otherwise, taxes will continue to increase.

So why is this important to us?

It is important because we understand that taxation is a necessity in order to have a healthy, wealthy, productive society for everyone, and in paying taxes there are circumstances which arise that make the system disadvantages to some Canadians.

Unlike our neighbours to the south who shoot elected officials for spending money, we are much more in control of our emotions (plus, no guns, eh?) so we need to hold them accountable in different ways, such as, not re-electing them. and going to public debates, and letting the officials that we elect know that they can no longer waste our money!

We can fix this.

The Truth and Myths Around the CRA’s Taxpayer Relief Program

There is quite a lot of information on the Internet around the Canada Revenue Agency’s (CRA) Taxpayer Relief Program (formerly known as fairness). Understandably, there is also a lot of misinformation around this program. After having spent almost 11 years working in the CRA – beginning as an entry-level collector and working my way up through the division to a team leader before taking my MBA and heading into the private sector – I have learned quite a lot about how the Taxpayer Relief program actually works.

This post will identify the key objectives of the program straight from the CRA, and then highlights some common myths about the program and the actual fact about why it makes sense to invest considerable time and effort into an application, or engage the services of someone who knows the program inside and out.

The Taxpayer Relief program was set up to allow for the Minister of National Revenue to grant relief from penalty and/or interest when the following types of situations prevent a taxpayer (individual or corporation) from meeting their tax obligations:

- Extraordinary circumstances;

- Actions of the Canada Revenue Agency (CRA);

- Inability to pay or financial hardship;

- Other circumstances

The program distinguishes between “cancelling” and “waiving” of penalties and/or interest as the CRA understands that granting relief to a taxpayer only to see them smothering in penalties and interest again is an exercise in futility.

The term “cancel” refers to a penalty or interest amount that is assessed or charged for which relief is granted, in whole or in part, by the CRA.

The term “waive” refers to a penalty or interest amount that is not yet assessed or charged for which relief is granted, in whole or in part, by the CRA.

The term “Taxpayer” includes individual, employer or payer, corporation, partnership, organization, trust, estate, goods and services tax/harmonized sales tax (GST/HST) registrant or claimant.

Now, you or your client, has been charged penalties and / or interest and you want to know if you qualify. Look no further than the CRA website, and their section on Taxpayer Relief, here.

Circumstances that may warrant relief include;

Extraordinary circumstances

Penalties or interest may be cancelled or waived in whole or in part when they result from circumstances beyond a taxpayer’s control. Extraordinary circumstances that may have prevented a taxpayer from making a payment when due, filing a return on time, or otherwise complying with a tax obligation include, but are not limited to, the following examples:

- Natural or human-made disasters, such as a flood or fire;

- Civil disturbances or disruptions in services, such as a postal strike;

- Serious illness or accident; and

- Serious emotional or mental distress, such as death in the immediate family.

Actions of the CRA

The CRA may also cancel or waive penalties or interest when they result primarily from CRA actions, including:

- Processing delays that result in taxpayers not being informed, within a reasonable time, that an amount was owing;

- Errors in CRA material which led a taxpayer to file a return or make a payment based on incorrect information;

- Incorrect information provided to a taxpayer by the CRA (usually in writing);

- Errors in processing;

- Delays in providing information, resulting in taxpayers not being able to meet their tax obligations in a timely manner; and

- Undue delays in resolving an objection or an appeal, or in completing an audit.

Inability to pay or financial hardship

The CRA may, in circumstances where there is a confirmed inability to pay amounts owing, consider waiving or cancelling interest in whole or in part to enable taxpayers to pay their account. For example, this could occur when:

- A collection has been suspended because of an inability to pay caused by the loss of employment and the taxpayer is experiencing financial hardship;

- A taxpayer is unable to conclude a payment arrangement because the interest charges represent a significant portion of the payments; or

- Payment of the accumulated interest would cause a prolonged inability to provide basic necessities (financial hardship) such as food, medical help, transportation, or shelter; consideration may be given to cancelling all or part of the total accumulated interest.

Consideration would not generally be given to cancelling a penalty based on an inability to pay or financial hardship unless an extraordinary circumstance prevented compliance, or an exceptional situation existed. For example, when a business is experiencing extreme financial difficulty and enforcement of such penalties would jeopardize the continuity of its operations, the jobs of the employees, and the welfare of the community as a whole, consideration may be given to providing relief of the penalties.

Other circumstances

The CRA may also grant relief if a taxpayer’s circumstances do not fall within the situations described above.

The CRA expects these guidelines to be used when applying for relief and that the requests are made within the deadlines for requesting relief, which is limited to any period that ended within 10 years before the calendar year in which a request is submitted or an income tax return is filed. The 10-year limitation period rolls forward every January 1st.

If filed using the correct form, with sufficient supporting documentation, a response from the Taxpayer Relief Program can take anywhere from 3 months to 2 years due to the amount of requests. In order to ensure that you are making the best claim possible, you really should engage the services of a professional, as they would be able to assess whether or not your request is sufficient, and they would ensure that you meet all the other conditions which must be in place for the CRA to review and consider your application.

At the end of the day, if you have a reasonable chance of being successful under this program, the investment made to have it written, reviewed or monitored by an expert is a worthwhile expenditure.

Now let’s have a look at some common myths around this program which are floating around the Internet.

Myths

Myth: That the CRA’s Taxpayer Relief program is a one time program and that you had better take your best shot the time you decide to apply.

Reality: Not true, This program is available to all Canadians who have been charged penalties and / or interest and as such, they have the right to ask for relief each and every time it is warranted. The Taxpayer Relief Group do not maintain collection inventories and as such they review each case on the merit of its submission without any influence from the permanent collections diary or the collector assigned to the case.

Myth: That the CRA’s Taxpayer Relief Program is used in order for the CRA and a taxpayer to negotiate a deal which would resolve the taxpayer’s debt issue by settling the debt and accepting less than the actual amount owed to them.

Reality: Never, ever, ever! The CRA does NOT settle debts outside of bankruptcy or a proposal, and they certainly do not use the taxpayer relief program for this purpose. As a matter of fact, I can speak of a first hand experience where a collector used the word “settle” in the permanent collection diary of a corporation which had paid a principle tax debt of $650,000, because they wanted to fight the $775,000 in penalties and interest through Taxpayer Relief. The CRA sent back the $650,000 and re-opened negotiation with the corporation because they did not want to set the precedent of settling tax debts through the Taxpayer Relief Program.

Myth: I cannot afford to pay my taxes, so I am not going to file my tax return, and then when I have a debt, I can ask for relief because I had no money?

Reality: Failure to file a tax return is a criminal offence which can result in prosecution, so you should always file, and be clear to the CRA upfront that money is tight. But before an application is made to the Taxpayer Relief Program, all outstanding returns must be filed up to date, and all installments must be accounted for. Otherwise, the application is set aside until everything is current.

Myth: Having a disability or illness from birth qualifies me for Taxpayer Relief.

Reality: Probably not. If you have managed to conduct your affairs for a period of time without any tax issues, but then something happens which cases the accumulation of penalties and interest, you cannot use your disability or illness when applying for relief, unless something happened during the period in which the penalties and / or interest were applied as a result of a worsening of your disability / illness. In that case, you would need to substantiate this with supporting letters from your doctors and specialists.

Myth: I met with someone who is going to write a letter to the CRA asking for relief and they have sent me the letter to review. If I sign it, and they send it off, am I now being considered for relief?

Reality: Not any more. Years ago, taxpayers were able to send in letters to the fairness department which contained their reasons for asking for relief and some would include supporting documentation, while others would not. However, since the CRA revamped the Taxpayer Relief Program, they require that the form RC4288 be included in the package or the claim will be rejected.

Myth: I need to be pre-qualified for the CRA Taxpayer Relief Program.

Reality: No. You can determine if you may qualify, or you can seek a professional to help you determine if you have grounds for relief, but there is no pre-qualification of this program.

Myth: If my claim is rejected, then I have to pay the penalties and interest.

Reality: You should make arrangements to pay the penalties and interest in any case in order to stop the interest clock from ticking should the claim be denied – wherever possible, however, the Taxpayer Relief Program allows for a second-level review to be performed (usually with additional information provided) and there is an option for judicial review should the second level review be unfavourable.

So take some time to look around when you are considering an application under the Taxpayer Relief Program and make sure that if you engage someone you do so for the right reasons.

Member of Nova Scotia First Nation charged with evading $2.2 million in taxes

The Canada Revenue Agency have announced that they have charged a member of Nova Scotia’s Millbrook First Nation with evading $2.2 million in GST/HST.

The CRA charged Lisa L. Marshall who was the operator of the Traditional Trading Post, a convenience store, located on the Cole Harbour reserve of the Millbrook First Nation using the Excise Tax Act with wilfully evading or attempting to evade compliance with that Act.

The CRA alleges that between July 1, 2010, and June 30, 2015, the store failed to collect or remit $2,284,144.72 in Goods and Services Tax (GST) and Harmonized Sales Tax (HST) related to the sale of tobacco products to non-Aboriginals.

The agency says people who fail to remit tax owing are liable not only for the full amount, but also to penalties and interest, and if convicted, the court can levy a fine of up to 200% of the tax evaded and also impose a prison term of up to 5 years.

The moral of the story here, is that if you are required to charge, collect and remit GST or HST, you should. The CRA treats Trust Funds – money taken by registrants and held in trust until they are remitted to the Crown – very seriously, and those who misuse Trust Funds are dealt with swiftly and to the full extent of the law allowed to be used by the CRA.

Tax Debt, Tax Arrears, Taxes Owing to the Canada Revenue Agency (CRA). Call it what you want, but it is ruining your life!

Do you have tax debt to the Canada Revenue Agency (CRA)? Tax arrears causes stress each and every day on you, your business and your family? Even if you are in an arrangement with the CRA, they can change their mind on a moments notice and want more. Knowing that the CRA can take all your money, or close your business at any time for your Tax Debt cannot help you sleep at night…

Everybody has answers for you which best suits themselves or their business.

We have a solution that best suits you and your business.

It’s called the Debt Diagnosis, and it’s a service we provide that no other tax solution / tax resolution / tax negotiator can provide.

Our Debt Diagnosis Program looks at the specifics of your CRA debt, your other debts, your current compliance situation, your assets, liabilities, ability to pay, and a whole bunch of other factors and we provide you with your options, suggestions and recommendations regarding how to proceed with your CRA debt(s).

We’ll advise you about options – options you know about already, like the CRA’s Taxpayer Relief Program, and the CRA’s Voluntary Disclosures Program – and we will tell you about options you don’t know about, and you won’t find in writing, because the CRA doesn’t want you to know about them.

As a former CRA Collections Senior Officer – who spent almost 11-years collecting primarily business taxes – GST/HST, Payroll, Corporate Tax, and Personal tax – and managing CRA Collections staff – I understand Director’s Liability, Non-Arms Length Assessments, Write-Off’s, Payment Arrangements, Taxpayer Relief, and everything else to do with collections better than anyone!

I created the Write-Off checklist that many CRA office’s use to write off their accounts.

I have resolved files that the CRA never thought they would collect on, while I was working at the CRA, and working outside the CRA.

Knowing the ins and outs of the CRA’s Collections division helps you!

Remember this: Getting in to Tax Debt takes time. Getting out of Tax Debt also takes time!

If someone is offering you a quick solution, then they are trying to get you into Bankruptcy, or filing a Consumer Proposal. Insolvency firms are creating “tax” centres to “help” you with your tax debts. They offer prompt resolution of CRA Collection actions, such as; Requirements to Pay and Wage Garnishments because if you go bankrupt the CRA cannot collect their debts… Most of the time.

Learn what options you have, which are specific to your Tax Debt / Tax Compliance matters.

The CRA has options available for Taxpayers who cannot pay their debts.

Use those, instead of trading Tax Debt for Credit Problems.

Talk to us at inTAXicating!

Find us @ http://www.inTAXicating.ca

Email us at info@intaxicating.ca

Learn the plan to take control of your Tax Debt, and all your other tax-related / debt-related issues and get moving in the right direction today.

There is no need to run to a trustee.

Or spend thousands and thousands of dollars to a firm who is going to promise solutions – tell you the CRA won’t budge on their position – and then tell you that the best option is to go bankrupt.

Get started on resolving your tax debt(s) today. The CRA still works in the summer!

Frequently Asked Tax Question Answered: How do I know if what I read about Tax Debt to the CRA is true?

This is one of the most commonly asked questions of me: How do I know if what I read on the Internet regarding debt to the Canada Revenue Agency (CRA) is true or not?

The answer is quite clear, however, complicated at the same time.

If you owe money to the CRA and you are looking for options, suggestions, or tips on the Internet, you have to pay special attention to the “Solution” options which are advertised as if they are providing legitimate advice.

The most important thing to do is to take note of the terminology used in these ads – over and over again – because the intention of these ads and blog posts are not to help you but to achieve a high SEO (search engine optimization) ranking. These posts are written to capitalize on the number of eyes who will read that post because of the way it was written, not because it was intended to provide help to you.

Here is an example of a fear mongering ad, disguised as an article on taxes, meant to “help” you. I am paraphrasing the content, but the example should provide a clear clue as to the true intention of the poster.

Title: Understanding Canada Revenue Agency (CRA) Tax Assessment & Arbitrary Assessments

The sample post: CRA tax assessment is when the Canada Revenue Agency conducts a review of your income taxes. The most common form of CRA tax assessment is the Notice of Assessment that is sent once the CRA has conducted a preliminary review of your tax return. There is another CRA assessment known as “arbitrary assessments.” These assessments are also known as “notational assessments.” What this means is that, if you have not filed your taxes on time, the CRA could decide to complete and file your return for you.

Many people believe that, if you do not file your taxes, that the CRA will wait until you do file your taxes and then the CRA will penalize you by changing you penalties, fines, and interest.

This is not always true.

The CRA is able to choose to complete an arbitrary assessment in which the Canada Revenue Agency will estimate your income and the tax debt that you owe and then the CRA will charge interest on this debt as required.

The amount of tax debt that comes from a CRA arbitrary assessment will not be as favourable to you as it would be if you completed your return yourself.

The CRA will use previous income tax statements to complete your return and will not take steps to include expenses or deductions or attempt to give you any tax breaks.

In many cases, the amount owing listed by the CRA will be very high and additional charges, penalties and interest will be charged since the assessment was late.

You will then be subject to CRA collection efforts such as a wage garnishment of up to 100% of your income, or the CRA will empty your bank account and then freeze it so you cannot use it. They could also put a lien on your house and if you don’t pay them, sell it and keep the proceeds.

What do you do if you Receive a Notational Assessment?

If you receive an arbitrary CRA tax assessment, your options are;

- Pay the amount listed

- File an appeal of the assessment.

- You can also choose to file a return yourself at this point in an attempt to reduce your tax bill, but, this will trigger a CRA audit to ensure that your tax return is filed correctly.

In addition, if the CRA does not have the information it needs in order to complete an arbitrary assessment, it can take you to court where the court can order that you complete the return and pay a court fine.

If you ignore this court order, you could be subject to contempt of court charges and go to jail.

As you can see, your best option is to contact us, and we will help solve this problem. We have an army of former CRA staff at our disposal who deal with hundreds of these daily.

Let us help keep you out of jail and away from the prying eyes of the CRA.

WHEW.

After reading this, if you were not afraid of the CRA, you must be by now. This blog post started out trying to get people looking for CRA tax solutions and slowly wound its way through a series of lies and mis-truths and took the reader straight to audit and jail. It just stopped short of proclaiming that King Tax Man was going to descend from the clouds and throw tennis sized hail-balls at you.

This type of article is not good. It’s not accurate, heck, some of it is not even true. But how would you know?

What are the red flags that you should notice?

Let’s break down this article and address some of the “facts”.

First paragraph – mentions of CRA, or Canada Revenue Agency – 5 times. This is their SEO target, clearly.

I was also alarmed that the writer was unable (or unwilling) to state what a Notice of Assessment (NOA) is, and how the CRA actually issues them. To set the record straight, a Notice of Assessment is the computer generated form which is issued once a change occurs on someone’s tax account. This NOA carries with it a legal warning from which the CRA are able to take collections actions.

An additional lie occurred when the author stated that your tax return is looked over once it is filed. In truth, no one has reviewed your tax return. The data entry group take the paper-filed returns and just enter the information in the system. Electronically filed tax returns are run through a program aimed at identifying any obvious errors or inaccurate deductions taken.

There is the idd case where the CRA will flag and wait for your tax return, however try not filing for 20-years and being under audit regularly, and then you can get to that level.

Canada’s tax system is a self-reporting system so the information is accepted as filed, and the Audit, or Verification department are responsible for checking the information to make sure it is correct after the fact.

Another HUGE issue, is that there is a significant difference between an arbitrary assessment and a notional assessment.

Arbitrary assessments are issued for personal (T1) taxes and occur when the CRA’s non-filer group, or a CRA collector takes information on your personal tax account for that current year, plus previous years and prepare the unfiled tax return for you, less deductions.

In many cases, they are pretty accurate.

A notional assessment is specific to GST/HST and in these cases the non-filer unit or the collections unit will assess an amount owing for each period outstanding based on a suggested amount the system provides. That suggested amount is a combination of the previous filings, and the industry or SIC code that is associated to your file.

In both cases, returns can be filed and the assessments removed, however, Notices of Objection should be attached just to provide recourse should the filings not be accepted.

Filing the missing returns does not trigger an audit.

The whole piece about the CRA taking you to court, etc., makes absolutely no sense as it’s not even true. Arbs and Notionals are based on information in the CRA’s systems. If the CRA doesn’t have information, they can still raise an assessment.

I suspect the writer was just trying to close out the reasons for using them by tieing in the jail / court fine, for not complying. It’s not true at all, but it makes for a compelling story!

If the intention of the article was to really assist Taxpayers and let each and every Canadian decide if they want to pay for assistance / expertise, then all they had to do was discuss prosecution which is what the CRA can and will do if repeated attempts to file have been issued from the CRA (Demand to File) and have not produced the returns.

Maybe they didn’t know that existed…

Maybe they were not aware that failing to file is a criminal offense, if the CRA asks for the returns and they are not provided.

Certainly, they did not want you to know that failing to pay is not.

If someone looked at the above post, they would panic, contact this firm, and likely be convinced to pay a lot of money for something they could likely do themselves because they don’t want to make it worse, or go to jail.

It’s hard to get the truth out there when there are people and firms distorting the facts in order to make a profit off of taxpayers lack of understanding of how the CRA works.

Additionally, if they intentionally muddled the facts in this post to scare you into using their services, what other information have they creatively adjusted?

Or, if they believe this to be the truth, then they just don’t have the experience or expertise to know better, and do you really want to use them to represent you in dealings with the CRA?

Outcome:

I questioned the author in an online social media forum. I said, “I’ve always understood that an arbitrary assessment was specific to T1 returns and that they were actually quite accurate because most of the information used is already posted to your T1 account, whereas a notional assessment was specific to GST/HST and those figures were based on the industry or SIC code. Can you confirm this is your understanding as well?”

He never responded…

Surprised?

I’m not.

When you have CRA tax collections problems then you need the expertise of the firm with an actual former CRA tax collector. inTAXicating Tax Services.

Visit us at http://www.inTAXicating.ca

Belgian Tax Authorities Going After Crypto-Currency Investors

It is no surprise, that the Tax authorities in Belgium, the Special Tax Inspectorate (STI) have begun to monitor investments involving Crypto-Currencies.

The STI have started investigating cases where citizens of Belgium have traded in digital currencies on foreign exchanges, and similar to many other countries around the world, the Belgium tax authorities are checking to see if these investors have been claiming their dealings and paying the 33% Capital Gains tax.

This gain would be reported in the “other income” section on a Belgian tax return.

Belgian tax authorities have found the taxation of Crypto-Currency challenging as every other county has, because the management of these assets takes place on foreign trading platforms and there is no jurisdiction around virtual space… Yet.

Likely, the Belgian tax authorities will follow suit of other countries and tax the gains as a commodity based on the location and / or residence of the trader.

The incentive to report will come in the way of significant penalties and interest when the STI finds the taxpayer before the taxpayer reports.

STI opened the investigations after receiving information from a foreign tax authority about the Crypto-Currency dealings of several Belgian citizens.

Information sharing among all tax authorities increased effective January 1, 2018 with the signing of The Multilateral Competent Authority Agreement (MCAA).

The MCAA is a multilateral framework agreement which provides a standardised and efficient mechanism to facilitate the automatic exchange of information in accordance with the Standard for Automatic Exchange of Financial Information in Tax Matters (Standard).

This new framework avoids the need for several bilateral agreements to be concluded, which means each participating country has ultimate control over exactly which exchange relationships it enters into and that each countries’ standards on confidentiality and data protection always apply.

In case you are ready to deem this framework illegal, the legal basis for MCAA rests in Article 6 of the Multilateral Convention on Mutual Administrative Assistance in Tax Matters (Convention) which provides for the automatic exchange of information between Parties to the Convention, where two Parties subsequently agree to do so.

So as it becomes easier to get information on local citizens from international tax regimes, you can expect government tax authorities, like the STI to continue to approach trading platforms, and other governments directly to obtain more data about Belgian citizens and their transactions related to digital currencies.

In December 2017, the Belgian tax agency, STI, agreed that a 33% withholding amount would be applied to profits and incomes from Belgian citizens who were involved in speculative trading of Bitcoin and other Crypto-Currency.

The tax is imposed on private individuals who trade in digital currencies with the intention of earning profits from the price fluctuations.

When the crypto trading is conducted by a business, or by an individual as a business, the tax rate might be as high as 50%.

Governments believe that Crypto-Currency companies should be obliged to cooperate with tax authorities, or as in the case of the US, where the IRS sent legal requirements to a firm, who were then required to do so by law.

In Belgium, Crypto-Currency are neither legal, nor illegal, however, the government have not announced a comprehensive policy yet, and like other EU Countries, appear to be waiting for a common European policy.

If you have been dabbling in Crypro-Currency, and not reported it on your Canadian Tax return, you should reach out to us at inTAXicating Tax Services, and we can help you amend your return, report the gaims, claim the losses and get filed before the CRA finds you!

info@intaxicating.ca

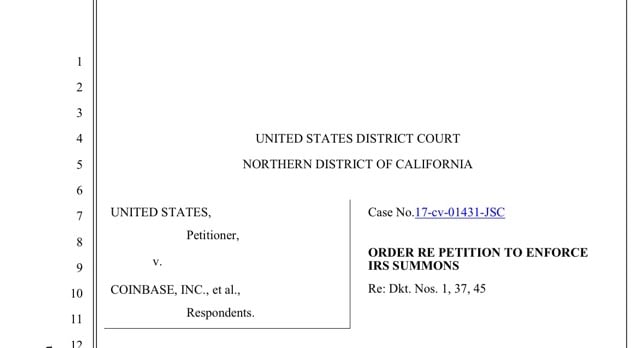

IRS Targets Crypto-Currency Exchange Coinbase and Wins!

A Popular cryptocurrency exchange, Coinbase, has been forced by a US court order to hand over a list of 13,000 of it’s customers’ names and assorted personal information to the Internal Revenue Service (IRS) so that the IRS can determine who has been reporting their Crypto-Currency transactions and to tax and penalize those who have not.

The link to the original article is here;

https://news.bitcoin.com/coinbase-compelled-by-irs-to-provide-13000-customers-information/

Coinbase, a San Francisco-based cryptocurrency exchange notified thousands of customers, to provide the IRS with “taxpayer ID, name, birth date, address, and historical transaction records for certain higher-transacting customers during the 2013-2015 period.”

While 13,000 is a lot, if you have used Crypto-Currencies in the US, or in Canada, you might want to get filing, and fast.

Apparently, Coinbase received a summons from the IRS in late 2016 asking for a wide range of records relating to approximately 500,000 Coinbase customers. Coinbase fought this summons in court – not sure if they won and the 13,000 is the win or if that matter is still pending but the 13,000 is a different attempt by the IRS to gather information they are entitled to under the IRC.

Still shocking to us at inTAXicating is how few Canadian and US crypto enthusiasts had even bothered to address the tax issue.

Many on both sides of the border claims that both the IRS and the CRA have been really vague on how they plan to address Crypto-Currencies, however than cannot be further from the truth.

On March 25th, 2014, the IRS issuesd this release; https://www.irs.gov/newsroom/irs-virtual-currency-guidance; and

On March 17, 2015, the CRA issued a release about how the Canada Revenue Agency will be handing Crypto-Currencies and they have been on top of it with the most recent detailed release being January 18th, 2018.

Whether you believe in taxation or that taxation is theft – something brought in from the BNA Act of 1867, or there are privacy rights stemming from the 3rd Amendment in the US, the bottom line is this.

If you don’t report your interactions with these digital currencies, you are going to pay that tax plus penalties and interest. Why give the government more than they are asking for? Include the currencies on your tax return, pay the tax, and be fully compliant.

If you have failed to include your adventures in Crypto-Currencies on your tax returns, you are in trouble. You need to contact inTAXicating and we can assist you in filing your returns to reflect those amounts.

Remember, the CRA’s Voluntary Disclosure Program is changing as of March 1st, 2018. Once that loophile closes, it’s going to be very difficult to get a fair shake from the government.

Don’t wait, hoping there is going to be miracle court order or that the CRA or IRS will decide that they have enough taxes already.

File!

inTAXicating can be reached at info@intaxicating.ca to book an appointment.

Copy of Court Order;

There’s plenty of misinformation regarding tax preparation and how to report digital currencies, however the CRA and IRS have been very clear.

If you have transacted publicly on any centralized exchanges such as Coinbase and are US or Canadian residents – and regardless of your opinion on the morality of tax – the IRS and the CRA have courts on their side and they can sentence you to jail.